gulvvarme på eksisterende betongulv

gulvvarme på eksisterende betongulv

NEW YORK (AP) — Stocks closed higher on Wall Street, sending the Dow Jones Industrial Average to another all-time high. The Dow added 1% Monday to the record it set on Friday. The S&P 500 rose 0.3%, while the Nasdaq composite rose 0.3%. Treasury yields eased in the bond market after President-elect Donald Trump said he wants Scott Bessent, a hedge fund manager, to be his Treasury Secretary. Smaller companies can feel a big boost from easier borrowing costs, and the Russell 2000 index of small stocks jumped 1.5%, closing just shy of the record high it set three years ago. THIS IS A BREAKING NEWS UPDATE. AP’s earlier story follows below. NEW YORK (AP) — Wall Street is set to break more records Monday as U.S. stocks rise to add to last week’s gains. The S&P 500 was 0.2% higher, as of 3 p.m. Eastern time, and sitting just below its all-time high set two weeks ago. The Dow Jones Industrial Average added 397 points, or 0.9%, to its own record set on Friday, while the Nasdaq composite was 0.1% higher. Treasury yields also eased in the bond market amid what some analysts called a “Bessent bounce” after President-elect Donald Trump said he wants Scott Bessent , a hedge fund manager, to be his Treasury Secretary. Bessent has argued for reducing the U.S. government’s deficit, which is how much more it spends than it takes in through tax and other revenue. Such an approach could soothe worries on Wall Street that Trump’s policies may lead to a much bigger deficit, which in turn would put upward pressure on Treasury yields. After climbing above 4.44% immediately after Trump’s election, the yield on the 10-year Treasury fell back to 4.26% Monday and down from 4.41% late Friday. That’s a notable move, and lower yields help make it cheaper for all kinds of companies and households to borrow money. They also give a boost to prices for stocks and other investments. That helped stocks of smaller companies lead the way, and the Russell 2000 index of smaller stocks jumped 2%. It’s set to top its all-time high, which was set three years ago. Smaller companies can feel bigger boosts from lower borrowing costs because of the need of many to borrow to grow. The two-year Treasury yield, which more closely tracks the market’s expectations for what the Federal Reserve will do with overnight interest rates, also eased sharply. The Fed began cutting its main interest rate just a couple months ago from a two-decade high, hoping to keep the job market humming after bringing high inflation nearly all the way down to its 2% target. But immediately after Trump’s victory, traders had reduced bets for how many cuts the Fed may deliver next year. They were worried Trump's preference for lower tax rates and higher spending on the border would balloon the national debt. . A report coming on Wednesday could influence how much the Fed may cut rates. Economists expect it to show that an underlying inflation trend the Fed prefers to use accelerated to 2.8% last month from 2.7% in September. Higher inflation would make the Fed more reluctant to cut rates as deeply or as quickly as it would otherwise. Goldman Sachs economist David Mericle expects that to slow by the end of next year to 2.4%, but he said inflation would be even lower if not for expected tariff increases on imports from China and autos favored by Trump. In the stock market, Bath & Body Works jumped 19.1% after delivering stronger profit for the latest quarter than analysts expected. The seller of personal care products and home fragrances also raised its financial forecasts for the full year, even though it still sees a “volatile retail environment” and a shorter holiday shopping season this year. Much focus has been on how resilient U.S. shoppers can remain, given high prices across the economy and still-high interest rates. Last week, two major retailers sent mixed messages. Target tumbled after giving a dour forecast for the holiday shopping season. It followed Walmart , which gave a much more encouraging outlook. Another big retailer, Macy’s, said Monday its sales for the latest quarter were in line with its expectations, but it will delay the release of its full financial results. It found a single employee had intentionally hid up to $154 million in delivery expenses, and it needs more time to complete its investigation. Macy’s stock fell 2.9%. Among the market's leaders were several companies related to the housing industry. Monday's drop in Treasury yields could translate into easier mortgage rates, which could spur activity for housing. Builders FirstSource, a supplier or building materials, rose 6.2%. Homebuilders, D.R. Horton, PulteGroup and Lennar all rose at least 5.8%. In stock markets abroad, indexes moved modestly across much of Europe after finishing mixed in Asia. In the crypto market, bitcoin was trading around $96,800 after threatening to hit $100,000 late last week for the first time. AP Business Writer Elaine Kurtenbach contributed.Award-Winning Author Patrick Finegan Releases New Novel - Toys in BabylonUnion announce offseason roster moves, part with Leon Flach

gulvvarme på eksisterende betongulv

NEW YORK (AP) — Stocks closed higher on Wall Street, sending the Dow Jones Industrial Average to another all-time high. The Dow added 1% Monday to the record it set on Friday. The S&P 500 rose 0.3%, while the Nasdaq composite rose 0.3%. Treasury yields eased in the bond market after President-elect Donald Trump said he wants Scott Bessent, a hedge fund manager, to be his Treasury Secretary. Smaller companies can feel a big boost from easier borrowing costs, and the Russell 2000 index of small stocks jumped 1.5%, closing just shy of the record high it set three years ago. THIS IS A BREAKING NEWS UPDATE. AP’s earlier story follows below. NEW YORK (AP) — Wall Street is set to break more records Monday as U.S. stocks rise to add to last week’s gains. The S&P 500 was 0.2% higher, as of 3 p.m. Eastern time, and sitting just below its all-time high set two weeks ago. The Dow Jones Industrial Average added 397 points, or 0.9%, to its own record set on Friday, while the Nasdaq composite was 0.1% higher. Treasury yields also eased in the bond market amid what some analysts called a “Bessent bounce” after President-elect Donald Trump said he wants Scott Bessent , a hedge fund manager, to be his Treasury Secretary. Bessent has argued for reducing the U.S. government’s deficit, which is how much more it spends than it takes in through tax and other revenue. Such an approach could soothe worries on Wall Street that Trump’s policies may lead to a much bigger deficit, which in turn would put upward pressure on Treasury yields. After climbing above 4.44% immediately after Trump’s election, the yield on the 10-year Treasury fell back to 4.26% Monday and down from 4.41% late Friday. That’s a notable move, and lower yields help make it cheaper for all kinds of companies and households to borrow money. They also give a boost to prices for stocks and other investments. That helped stocks of smaller companies lead the way, and the Russell 2000 index of smaller stocks jumped 2%. It’s set to top its all-time high, which was set three years ago. Smaller companies can feel bigger boosts from lower borrowing costs because of the need of many to borrow to grow. The two-year Treasury yield, which more closely tracks the market’s expectations for what the Federal Reserve will do with overnight interest rates, also eased sharply. The Fed began cutting its main interest rate just a couple months ago from a two-decade high, hoping to keep the job market humming after bringing high inflation nearly all the way down to its 2% target. But immediately after Trump’s victory, traders had reduced bets for how many cuts the Fed may deliver next year. They were worried Trump's preference for lower tax rates and higher spending on the border would balloon the national debt. . A report coming on Wednesday could influence how much the Fed may cut rates. Economists expect it to show that an underlying inflation trend the Fed prefers to use accelerated to 2.8% last month from 2.7% in September. Higher inflation would make the Fed more reluctant to cut rates as deeply or as quickly as it would otherwise. Goldman Sachs economist David Mericle expects that to slow by the end of next year to 2.4%, but he said inflation would be even lower if not for expected tariff increases on imports from China and autos favored by Trump. In the stock market, Bath & Body Works jumped 19.1% after delivering stronger profit for the latest quarter than analysts expected. The seller of personal care products and home fragrances also raised its financial forecasts for the full year, even though it still sees a “volatile retail environment” and a shorter holiday shopping season this year. Much focus has been on how resilient U.S. shoppers can remain, given high prices across the economy and still-high interest rates. Last week, two major retailers sent mixed messages. Target tumbled after giving a dour forecast for the holiday shopping season. It followed Walmart , which gave a much more encouraging outlook. Another big retailer, Macy’s, said Monday its sales for the latest quarter were in line with its expectations, but it will delay the release of its full financial results. It found a single employee had intentionally hid up to $154 million in delivery expenses, and it needs more time to complete its investigation. Macy’s stock fell 2.9%. Among the market's leaders were several companies related to the housing industry. Monday's drop in Treasury yields could translate into easier mortgage rates, which could spur activity for housing. Builders FirstSource, a supplier or building materials, rose 6.2%. Homebuilders, D.R. Horton, PulteGroup and Lennar all rose at least 5.8%. In stock markets abroad, indexes moved modestly across much of Europe after finishing mixed in Asia. In the crypto market, bitcoin was trading around $96,800 after threatening to hit $100,000 late last week for the first time. AP Business Writer Elaine Kurtenbach contributed.Award-Winning Author Patrick Finegan Releases New Novel - Toys in BabylonUnion announce offseason roster moves, part with Leon Flach

LAS VEGAS — Players Era Festival organizers have done what so many other have tried — bet their fortunes in this city that a big payoff is coming. Such bet are usually bad ones, which is why so many massive casino-resorts have been built on Las Vegas Boulevard. But it doesn't mean the organizers are wrong. They're counting on the minimum of $1 million in guaranteed name, image and likeness money that will go to each of the eight teams competing in the neutral-site tournament that begins Tuesday will create a precedent for other such events. EverWonder Studios CEO Ian Orefice, who co-founded Players with former AND1 CEO Seth Berger, compared this event to last year's inaugural NBA In-Season Tournament that played its semifinals and final in Las Vegas by saying it "did really well to reinvigorate the fan base at the beginning of the year." "We're excited that we're able to really change the paradigm in college basketball on the economics," Orefice said. "But for us, it's about the long term. How do we use the momentum that is launching with the 2024 Players Era Festival and be the catalyst not to change one event, but to change college basketball for the future." Orefice and Berger didn't disclose financial details, but said the event will come close to breaking even this year and that revenue is in eight figures. Orefice said the bulk of the revenue will come from relationships with MGM, TNT Sports and Publicis Sport & Entertainment as well as sponsors that will be announced later. Both organizers said they are so bullish on the tournament's prospects that they already are planning ahead. Money made from this year's event, Orefice said, goes right back into the company. "We're really in this for the long haul," Orefice said. "So we're not looking at it on a one-year basis." Rick Giles is president of the Gazelle Group, which also operates several similar events, including the College Basketball Invitational. He was skeptical the financial numbers would work. Giles said in addition to more than $8 million going to the players, there were other expenses such as the guarantees to the teams. He said he didn't know if the tournament would make up the difference with ticket sales, broadcast rights and sponsorship money. The top bowl of the MGM Grand Garden Arena will be curtained off. "The math is highly challenging," Giles said. "Attendance and ticket revenues are not going to come anywhere close to covering that. They haven't announced any sponsors that I'm aware of. So it all sort of rests with their media deal with Turner and how much capital they want to commit to it to get these players paid." David Carter, a University of Southern California adjunct professor who also runs the Sports Business Group consultancy, said even if the Players isn't a financial success this year, the question is whether there will be enough interest to move forward. "If there is bandwidth for another tournament and if the TV or the streaming ratings are going to be there and people are going to want to attend and companies are going to want to sponsor, then, yeah, it's probably going to work," Carter said. "But it may take them time to gain that traction." Both founders said they initially were met with skepticism about putting together such an event, especially from teams they were interested in inviting. Houston was the first school to commit, first offering an oral pledge early in the year and then signing a contract in April. That created momentum for others to join, and including the No. 6 Cougars, half the field is ranked. "We have the relationships to operate a great event," Berger said. "We had to get coaches over those hurdles, and once they knew that we were real, schools got on board really quickly." The founders worked with the NCAA to make sure the tournament abided by that organization's rules, so players must appear at ancillary events in order to receive NIL money. Strict pay for play is not allowed, though there are incentives for performance. The champion, for example, will receive $1.5 million in NIL money. Now the pressure is on to pull off the event and not create the kind of headlines that can dog it for years to come. "I think everybody in the marketplace is watching what's going to happen (this) week and, more importantly, what happens afterwards," Giles said. "Do the players get paid on a timely basis? And if they do, that means that Turner or somebody has paid way more than the market dictates? And the question will be: Can that continue?" CREIGHTON: P oint guard Steven Ashworth likely won’t play in the No. 21 Bluejays’ game against San Diego State in the Players Era Festival in Las Vegas. Ashworth sprained his right ankle late in a loss to Nebraska on Friday and coach Greg McDermott said afterward he didn’t know how long he would be out. Be the first to know Get local news delivered to your inbox!

Thanksgiving travelers: Airport strike, bad weather, and more could cause delays

DirecTV extends its agreement as title sponsor of the Holiday BowlBETHESDA, Md. , Dec. 11, 2024 /PRNewswire/ -- AGNC Investment Corp. (Nasdaq: AGNC) ("AGNC" or the "Company") announced today that its Board of Directors has declared cash dividends on the outstanding depositary shares 1 of the following series of preferred stock for the fourth quarter 2024: Series of Preferred Stock Ticker Per Annum Dividend Rate Dividend Per Depositary Share 1 7.00% Series C Fixed-to-Floating Rate AGNCN 10.01991% 2 $0.64016 6.875% Series D Fixed-to-Floating Rate AGNCM 9.24091% 3 $0.59039 6.50% Series E Fixed-to-Floating Rate AGNCO 9.90191% 4 $0.63262 6.125% Series F Fixed-to-Floating Rate AGNCP 6.125 % $0.3828125 7.750% Series G Fixed-Rate Reset AGNCL 7.750 % $0.48438 1. Each depositary share represents a 1/1,000th interest in a share of preferred stock. 2. The Series C Depositary Shares accrue dividends at a floating rate equal to Three-Month CME Term SOFR plus 0.26161% plus 5.111%. The dividend rate for the dividend period ending January 14, 2025 is 10.01991% per annum. 3. The Series D Depositary Shares accrue dividends at a floating rate equal to Three-Month CME Term SOFR plus 0.26161% plus 4.332%. The dividend rate for the dividend period ending January 14, 2025 is 9.24091% per annum. 4. The Series E Depositary Shares accrue dividends at a floating rate equal to Three-Month CME Term SOFR plus 0.26161% plus 4.993%. The dividend rate for the dividend period ending January 14, 2025 is 9.90191% per annum. The dividend for each series of outstanding preferred stock is payable on January 15, 2025 to holders of record as of January 1, 2025 . For further information or questions, please contact Investor Relations at (301) 968-9300 or IR@AGNC.com . ABOUT AGNC INVESTMENT CORP. Founded in 2008, AGNC Investment Corp. (Nasdaq: AGNC) is a leading investor in Agency residential mortgage-backed securities (Agency MBS), which benefit from a guarantee against credit losses by Fannie Mae, Freddie Mac, or Ginnie Mae . We invest on a leveraged basis, financing our Agency MBS assets primarily through repurchase agreements, and utilize dynamic risk management strategies intended to protect the value of our portfolio from interest rate and other market risks. AGNC has a track record of providing favorable long-term returns for our stockholders through substantial monthly dividend income, with over $13 billion of common stock dividends paid since inception. Our business is a significant source of private capital for the U.S. residential housing market, and our team has extensive experience managing mortgage assets across market cycles. To learn more about The Premier Agency Residential Mortgage REIT , please visit www.AGNC.com , follow us on LinkedIn and X , and sign up for Investor Alerts . CONTACT: Investor Relations - (301) 968-9300 View original content: https://www.prnewswire.com/news-releases/agnc-investment-corp-declares-fourth-quarter-dividends-on-preferred-stock-302329441.html SOURCE AGNC Investment Corp.

Canadiens' Mike Matheson out against Utah with lower-body injuryFeds suspend ACA marketplace access to companies accused of falsely promising ‘cash cards’The prosecutor leading the US government’s election interference and classified documents cases against Donald Trump has filed a motion to drop all charges against the president-elect. Special Counsel Jack Smith is expected to resign before Trump takes office in January. Smith filed his motion in the election interference case on Monday, writing that while “the Government’s position on the merits of the defendant’s prosecution has not changed,” Justice Department policy prohibits the criminal prosecution of a sitting president. “That prohibition is categorical and does not turn on the gravity of the crimes charged, the strength of the Government’s proof, or the merits of the prosecution, which the Government stands fully behind,” Smith continued in his submission to a federal court in Washington DC. District Judge Tanya Chutkan will now have to grant Smith’s request in order for the case to be dismissed. Smith charged Trump last year with plotting to overthrow President Joe Biden’s 2020 election win, arguing that Trump pressured election officials to invalidate the results and encouraged his supporters to riot at the US Capitol on January 6, 2021, in a bid to block the certification of Biden’s victory. Trump faced four felony counts: conspiracy to defraud the United States, conspiracy to obstruct an official proceeding, obstruction of and attempt to obstruct an official proceeding and conspiracy against rights. Then candidate Trump derided Smith as a “deranged lunatic,” and called the case a “pathetic attempt” by the Biden administration to jail a political opponent. In a separate filing in Florida on Monday, Smith dropped his appeal against a district judge’s decision to throw out another case against Trump, this one concerning his alleged mishandling of classified documents after leaving office in 2021. Smith charged Trump with 40 criminal counts after FBI agents recovered troves of government papers in a pre-dawn raid on his Mar-a-Lago estate last year, but the case was dismissed in July after District Judge Aileen Cannon ruled that Smith did not have the authority to prosecute the former president. After abandoning his two cases against Trump, Smith is expected to resign before the president-elect takes office on January 20. Even if Smith were to cling on to his position, Trump has already vowed to fire the “crooked” prosecutor “within two seconds” of taking office. Aside from Smith’s two federal cases, Trump was charged in New York with misreporting “hush money” payments to porn star Stormy Daniels, and in Georgia with conspiring to overturn the results of the 2020 election in the state. He was found guilty on all counts in New York in May, after Manhattan District Attorney Alvin Bragg successfully elevated one misdemeanor offense to 34 felonies, one for each installment paid to Daniels. Trump was due to be sentenced in New York later this month. However, Judge Juan Merchan postponed the sentencing indefinitely on Friday, and agreed to hear a motion from Trump’s lawyers to dismiss the case altogether. The president-elect is still facing state-level election interference charges in Georgia, although three counts were dropped earlier this year. Oral arguments were canceled last week, and the case is widely expected to be dismissed before Trump’s inauguration.None

Germany is to vote in an early election on February 23 after Chancellor Olaf Scholz’s three-party governing coalition collapsed last month in a dispute over how to revitalise the country’s stagnant economy. Mr Musk’s guest opinion piece for Welt am Sonntag – a sister publication of Politico owned by the Axel Springer Group – published in German over the weekend, was the second time this month that he has supported the Alternative for Germany, or AfD. “The Alternative for Germany (AfD) is the last spark of hope for this country,” he wrote in his translated commentary. He went on to say that the far-right party “can lead the country into a future where economic prosperity, cultural integrity and technological innovation are not just wishes, but reality”. The Tesla Motors chief executive also wrote that his investment in Germany gives him the right to comment on the country’s condition. The AfD is polling strongly, but its candidate for the top job, Alice Weidel, has no realistic chance of becoming chancellor because other parties refuse to work with the far-right party. Billionaire Mr Musk, an ally of US President-elect Donald Trump, challenged in his opinion piece the party’s public image. “The portrayal of the AfD as right-wing extremist is clearly false, considering that Alice Weidel, the party’s leader, has a same-sex partner from Sri Lanka! Does that sound like Hitler to you? Please!” Mr Musk’s commentary has led to a debate in German media over the boundaries of free speech, with the paper’s own opinion editor announcing her resignation, pointedly on Mr Musk’s social media platform, X. Eva Marie Kogel wrote: “I always enjoyed leading the opinion section of WELT and WAMS. Today an article by Elon Musk appeared in Welt am Sonntag. I handed in my resignation yesterday after it went to print.” A critical article by the future editor-in-chief of the Welt group, Jan Philipp Burgard, accompanied Mr Musk’s opinion piece. “Musk’s diagnosis is correct, but his therapeutic approach, that only the AfD can save Germany, is fatally wrong,” he wrote. Responding to a request for comment from the German Press Agency, dpa, the current editor-in-chief of the Welt group, Ulf Poschardt, and Mr Burgard – who is due to take over on January 1 – said in a joint statement that the discussion over Mr Musk’s piece was “very insightful. Democracy and journalism thrive on freedom of expression.” “This will continue to determine the compass of the ‘world’ in the future. We will develop ‘Die Welt’ even more decisively as a forum for such debates,” they wrote to dpa.Tesla After-Hours Stock Price Skyrockets! What This Means for Gamers

‘Nebraska did a good job': Boston College's Bill O'Brien lauds NU’s red zone defenseThe Onion's rejected purchase of Infowars in an auction bid supported by families of the Sandy Hook Elementary shooting dealt them a new setback Wednesday and clouded the future of Alex Jones' conspiracy theory platform, which is now poised to remain in his control for at least the near future. What's next for Infowars and Sandy Hook families' long-sought efforts to hold Jones accountable over calling one of the deadliest school shootings in U.S. history a hoax was unclear, after a federal judge in Houston late Tuesday rejected The Onion's winning bid for the site . U.S. Bankruptcy Judge Christopher Lopez in Houston said he did not want another auction but offered no roadmap over how to proceed. One possibility includes ultimately allowing Sandy Hook families — who comprise most of Jones' creditors — to return to state courts in Connecticut and Texas to collect on the nearly $1.5 billion in defamation and emotional distress lawsuit judgments that Jones was ordered to pay them. “Our hope is that when this process ends, and it will end, and it will end sooner rather than later, is that all assets that Alex Jones has available are paid to the families, and that includes Infowars, and that as a result of that process Alex Jones is deprived of the ownership and control of the platform that he’s used to hurt so many people,” Christopher Mattei, an attorney for the Sandy Hook families, said in a phone interview Wednesday. The families, meanwhile, were preparing the mark the 12th anniversary of the Dec. 14 shooting. The sale of Infowars is part of Jones’ personal bankruptcy case , which he filed in late 2022 after he was ordered to pay the $1.5 billion. Jones was sued for repeatedly saying on his show that the 2012 massacre of 20 first graders and six educators was staged by crisis actors to spur more gun control. Lopez said there was a lack of transparency in the bidding process and too much confusion about The Onion's bid. He also said the amount of money offered in the only two bids was too low and there needed to be more effort to try to raise as much money possible from the selling of Infowars' assets. The Onion's parent company, Global Tetrahedron, submitted a $1.75 million cash offer with plans to kick Jones out and relaunch Infowars in January as a parody . The bid also included a deal with many of the Sandy Hook families for them to forgo $750,000 of their auction proceeds and give it to other creditors. Lopez called it a complex arrangement that led to different interpretations of the bid's actual value as well as last-minute changes to a proposed sale order. The other bidder was First United American Companies, which runs a website in Jones’ name that sells nutritional supplements and planned to let Jones stay on the Infowars platforms. It offered $3.5 million in cash and later, with Jones, alleged fraud and collusion in the bidding process. Lopez rejected the allegations, saying that while mistakes were made there was no wrongdoing. Christopher Murray, the trustee who oversaw the auction, said he picked The Onion and its deal with the Sandy Hook families because it would have provided more money to Jones' other creditors. The next steps remained unclear Wednesday. The judge directed Murray to come up with a new plan to move forward. Murray and representatives of The Onion did not immediately return messages seeking comment. The judge said there was a possibility there could be a trial in 2025 to settle Jones' bankruptcy. He said Murray could try to sell the equity in Infowars' parent company. He also said Murray could abandon the efforts, which could allow the Sandy Hook families to return to the state courts where they won their lawsuits against Jones and begin collection proceedings against him. The judge said he wanted to hear back from Murray and others involved in the bankruptcy within 30 days on a plan to move forward. Mattei, who represented the Sandy Hook families in the Connecticut lawsuit, said everyone is waiting to see what plan the trustee comes up with. Jones, meanwhile, continued to allege fraud and collusion on his show Wednesday and threatened legal action over what he called an attempted “rigged auction.” On the social media platform X, he called the judge's ruling a “Major Victory For Freedom Of The Press & Due Process." “I don’t want to have to go after these people, lawsuit-wise, but we have to because if you don’t then you’re aiding and abetting and they do it to other people. They made some big mistakes," he said. It's a solemn and heartbreaking week for relatives of victims of the Sandy Hook shooting in Newtown, Connecticut. The 12th anniversary is Saturday, and some of the victims' relatives were traveling to Washington, D.C., to attend the annual National Vigil for All Victims of Gun Violence on Wednesday evening. The families usually mark the anniversary out of the public eye. Many of the families said their lawsuits against Jones bought back the unbearable pain of losing their loved ones, as well as the trauma of being harassed and threatened by believers of Jones' hoax conspiracy. Relatives said they have been confronted in public by hoax believers and received death and rape threats. Robbie Parker, whose 6-year-old daughter Emilie was killed, testified at the Connecticut lawsuit trial in 2022 that the decade of abuse his family suffered made them move across the country to Washington state, and even there he was accosted in person. The families have not received any money from Jones since winning the trials. Jones has been appealing the $1.5 billion in judgments, and has since conceded that the shooting did happen. Last week, a Connecticut appeals court upheld most of the judgment in that state but reduced it by $150 million. Associated Press writer Juan A. Lozano in Houston contributed to this report.

Jannik Sinner leads Italy back to the Davis Cup semifinals and a rematch against Australia

What happens next with Alex Jones' Infowars? No certainty yet after sale to The Onion is rejectedOld friends Corey Conners and Brooke Henderson usually have to keep tabs on each other from afar, but this week they'll get to see one another up close. Read this article for free: Already have an account? As we navigate through unprecedented times, our journalists are working harder than ever to bring you the latest local updates to keep you safe and informed. Now, more than ever, we need your support. Starting at $14.99 plus taxes every four weeks you can access your Brandon Sun online and full access to all content as it appears on our website. or call circulation directly at (204) 727-0527. Your pledge helps to ensure we provide the news that matters most to your community! Old friends Corey Conners and Brooke Henderson usually have to keep tabs on each other from afar, but this week they'll get to see one another up close. Read unlimited articles for free today: Already have an account? Old friends Corey Conners and Brooke Henderson usually have to keep tabs on each other from afar, but this week they’ll get to see one another up close. Conners and Henderson will team up once again at the Grant Thornton Invitational, a unique event where some of the best golfers from the PGA and LPGA Tours compete as pairs. The tournament is quickly becoming an annual reunion for the two graduates of Golf Canada’s junior program. “Since turning professional, our careers have gone separate ways, and we haven’t been able to cross paths too much,” said Conners, who finished the men’s season 39th on the FedEx Cup standings. “I’m always cheering her on from afar, and always have my eye on the LPGA Tour leaderboard when she’s playing.” Henderson, likewise, has been keeping tabs on Conners’s exploits. “It’s just been really fun to watch his career and cheer him on,” said Henderson, who finished 13th in the women’s tour’s rankings. “I think this event has reconnected us, in a way, and it’s been really special and great to be able to know his family and just to watch this game and be his partner here is really cool.” Both were on Team Canada back in 2013 when they won the Copa de las Americas along with Albin Choi and Augusta James. Conners and Henderson also represented Canada at the last two Olympics but due to COVID-19 restrictions they didn’t get to interact at the Tokyo Games in 2021. The men’s and women’s tournaments were on different weeks at the Paris Games this past summer. The two Canadians finished second at the inaugural Grant Thornton Invitational last year with a combined score of 25 under, a shot behind New Zealand’s Lydia Ko and Australia’s Jason Day. “It’s been great to be able to share some experiences like the Olympics and this event last year and spending more time together has been awesome,” said Conners, who is from Listowel, Ont. “She’s this amazing person, amazing golfer, and a fun partner at this event.” The stacked leaderboard will see 16 pairs tee off on Friday at Tiburon Golf Club in Naples, Fla. American Tony Finau withdrew from the event on Wednesday afternoon. He was replaced as top-ranked Nelly Korda’s partner by Daniel Berger. “I feel like we make a great team, and I’m excited for Friday to tee it up and hopefully make some birdies and be inspired by (Conners’s) great shots,” said Henderson, who is from Smiths Falls, Ont. PGA TOUR — Six Canadians are vying for a PGA Tour card at the PGA Tour Q-School this week. Roger Sloan of Merritt, B.C., Edmonton’s Wil Bateman, Myles Creighton of Digby, N.S., Toronto’s Sebastian Szirmak, as well as Matthew Anderson and Sudarshan Yellamaraju of Mississauga, Ont., will all be in the field at Dye’s Valley Course and Sawgrass Country Club in Ponte Vedra Beach, Fla., this week. LPGA TOUR — Hamilton’s Alena Sharp and Maude-Aimee Leblanc of Sherbrooke, Que., both earned full status on the LPGA Tour for 2025 after solid showings at the final qualifying stage of the Q-Series on Monday. Sharp tied for 21st at 7 under and Leblanc tied for 24th at 6 under. The top 25 finishers in the tournament earned their status. GOLFZON TOUR — A team of five golfers from the Greater Toronto Area will be competing in the GOLFZON Tour, a golf simulator league that features 12 teams from North America and the United Kingdom. Team Toronto will play its GOLFZON Tour quarterfinal match at a Golfplay location in Waterloo, Ont., on the virtual Old Course at St. Andrews against Team Orlando on Dec. 19. This report by The Canadian Press was first published Dec. 11, 2024. Advertisement Advertisement

NoneThe deputy leader of the Social Democrats is “very angry” about misleading statements made by a newly-elected party TD over his shares in a company linked to the Israeli military. Cian O’Callaghan said on Wednesday that the parliamentary party had voted unanimously to suspend the politician after what he said was an “embarrassing” and “unacceptable” incident. Advertisement Speaking after engaging with Fine Gael and Fianna Fáil on government formation talks, he said: “It has affected our standing and we have a lot of work to do on this in the future.” He added: “We’ve taken a knock – and deservedly so – but we’ve just been elected by people and we got a very strong mandate and people are saying very strongly that they really want us to act on issues like housing, healthcare, childcare, disability services and climate action.” Newly elected TD for Dublin Bay South, Eoin Hayes, centre (Cate McCurry/PA) Advertisement The suspended politician, Eoin Hayes, had originally told the media and his party colleagues that he divested shares in his former employer, Palantir Technologies, prior to being elected to Dublin City Council in June. However, following reporting from the Daily Mail newspaper, he later revealed that he actually sold the shares in July – after taking office – for a pre-tax figure of €199,000. The company supplies technology to Israel’s military. He went on to win a Dáil seat in Dublin Bay South in last month’s general election. The timing of the sale did not line up with his public comments or statements from the leader of the Social Democrats, who has been a vociferous critic of Israel’s actions in the war in Gaza. Advertisement Social Democrats leader Holly Cairns (Brian Lawless/PA) Holly Cairns had called for economic sanctions against Israel in November last year, when Mr Hayes still had shareholding in Palantir. The Social Democrats said they had suspended Mr Hayes after the correct timing of the disposal of the shares was revealed. He said he would sit in the Dáil as an Independent. Advertisement Speaking to reporters about the incident on Wednesday, Mr O’Callaghan said the party had been given inaccurate information about when Mr Hayes sold his shares. He said he had requested that the party’s national executive review all of the issues leading up Mr Hayes’ suspension. Asked if there was any route for Mr Hayes back into the party, Mr O’Callaghan said they were not at the point of “knowing what was going to happen into the future”. Pressed on whether complete expulsion was a possibility, he said the review into the matter would take a number of weeks. Advertisement Social Democrats TD Gary Gannon (Niall Carson/PA) He said that Ms Cairns, who gave birth to a baby girl two less than two weeks ago, was “extremely disappointed” about the matter. On the overall situation, Mr O’Callaghan said: “Media do a very important job holding us to account and at all times information given to me and, indeed, the public and ourselves should be accurate.” Prior to the updated disclosure of the selling of the shares, senior party TD Gary Gannon suggested on a podcast that a journalist pursuing the story of Mr Hayes’ work in Palantir was looking for a job as a government adviser. On Wednesday, Mr Gannon apologised for the remarks. He said he retracted the comments and that they did not reflect the views of the party: “It was a poor comment to make, it wasn’t acceptable and I apologise”. “It was grossly silly comment and it won’t happen again.” He added: “I let the party down last week after a heavy general election. I was tired, I wasn’t being my best self.” Asked if Mr Gannon had been disciplined, Mr O’Callaghan said the comments were not acceptable. Mr Hayes was given shares in the company, which supplies technology to Israel to assist in its war in Gaza, when he worked for the firm between 2015 and 2017. He said: “I had absolutely no role in anything related to any military contracts – for the Israeli military or anyone else. “As part of my salary package I was provided with shares. The conditions attaching to those shares meant I was unable to sell them until 2021 – six months after the company had gone public.” He added: “Throughout the course of the past year, Palantir’s support for the Israeli military has markedly increased. “In January, the company signed a new strategic partnership with the Israeli defence ministry. I should have sold my shares then and I deeply regret that I did not.” Mr Hayes said he apologised “unreservedly” for providing incorrect information.

NoneWhat happens next with Alex Jones' Infowars? No certainty yet after sale to The Onion is rejected

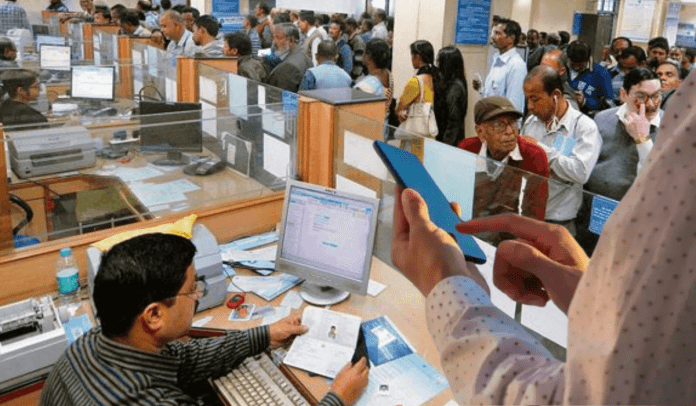

In October, a video on social media showed the manager of Social Islami Bank's Agargaon branch breaking down in tears after enduring harsh verbal abuse from frustrated customers seeking to withdraw cash. It didn't take long to go viral. The severe cash crunch at Social Islami Bank was far from an isolated incident. Throughout October and November, protests erupted inside the branches of several banks, with angry clients blocking branch managers to recover their money. The social media footage itself was a testament to the fragile state of the banking sector — a system teetering under the weight of corruption, mismanagement and a crisis of confidence. At the heart of the turmoil were several Shariah-based banks heavily controlled by S Alam Group, a controversial business conglomerate whose governance failures and financial irregularities cast a shadow over the entire sector. For years, the true state of Bangladesh's banking system remained obscured by political interference and flawed policies during Sheikh Hasina's 15-year rule. After her fall in early August, the extent of the dysfunction became painfully clear. In 2024, the banking sector faced a perfect storm of challenges: liquidity shortages in Shariah-based lenders, foreign exchange instability, soaring inflation, ill-conceived mergers and a seismic increase in non-performing loans. As part of its $4.7 billion loan programme for Bangladesh, the International Monetary Fund (IMF) made financial sector reforms a key condition. While the previous government had resisted the demands for reform, the interim administration that came after Hasina's exit moved swiftly to address systemic irregularities and implement a broad reform agenda. Towards the end of the year, a slew of steps had been taken, though the path to stability remained fraught with difficulty. A GLOOMY START The year began under a cloud of economic uncertainty. Inflation surged to 11.66 percent in July -- the highest in 13 years. The price pressure has been hovering above the 9 percent mark since March 2023. Despite the government and the central bank's efforts, including multiple policy rate hikes, inflationary pressures showed little sign of easing. To make things worse, the foreign exchange market faced unrelenting volatility for months. Over two years, the country's dollar stocks had halved and local currency Taka had depreciated by about 28 percent. These burdens further strained the banking sector, specially for Shariah-based lenders already wrestling with governance failures and liquidity shortfalls. BB's LIQUIDITY SUPPORT ALL THROUGH 2024 To protect the banking sector from a collapse, the Bangladesh Bank (BB) injected fresh funds into struggling banks throughout the year. The lack of securities tied to these liquidity supports fueled inflation and drew criticism for making things difficult in the long run. Critics argued that such measures merely postponed the reckoning, without addressing the structural flaws undermining the sector. At the end of 2023, the central bank provided Tk 22,000 crore in emergency funds to seven beleaguered banks, including five Islamic ones, to dress up their balance sheets before the year closed. Then, in January, the banking regulator provided Tk 12,000 crore to six banks against the special purpose treasury bond issued by the government to settle outstanding payments for fertiliser and power. Economists came down heavily on these fund injections, arguing that those fueled inflation by "printing money". Under the interim government, the central bank also extended Tk 22,500 crore as liquidity support to six crisis-hit banks in November. FAULTY MERGER MOVE As per the instruction of the previous government, Abdur Rouf Talukder, former governor of the central bank, took an initiative to merge five weak banks with sound ones. The move prompted massive instability in the banking sector as depositors of the weak banks rushed to withdraw cash. The decision to merge the weak and problematic Padma Bank with the EXIM Bank in March was the first merger initiative. Later, names of a few more banks came to light for merger, which eventually caused the lenders to face a liquidity crisis due to massive deposit withdrawals. However, after the political changeover, the merger decision was cancelled. THE RETURN OF MARKET-BASED INTERESTS In May this year, the BB was forced to reintroduce market-based interest rates after shelving it for four years. The reintroduction was to meet the conditions of the IMF. The central bank, in line with the government instruction in 2020, introduced a single-digit lending rate which allowed banks to charge a maximum 9 percent interest rate on lending. Economists criticised the single-digit lending rate policy as it created an opportunity for bad borrowers to take funds at a cheap rate and launder it abroad. The single-digit lending rate also contributed to high inflation. In July 2023, the central bank withdrew the 9 percent lending rate cap and introduced the Six-Months Moving Average Rate of Treasury bills (SMART) formula for setting the interest rate. In May this year, the banking regulator scrapped the SMART formula to let the market decide interest rates on commercial lending. At the same time, the BB introduced a crawling peg exchange rate system for buying and selling foreign currencies and allowed banks to buy and sell US dollars at around Tk 117. BAD LOANS REACHED RECORD HIGH At the end of September this year, non-performing loans (NPLs) in the banking sector reached Tk 2,84,977 crore. The figure included a massive Tk 73,586 crore defaulted in just three months. Between July and September, bad debts soared by 34.8 percent, according to the BB. Industry insiders said that the actual scenario of the sector came to light less than two months after the fall of Sheikh Hasina on August 5. The actual bad loans will likely cross Tk 5,00,000 crore when rescheduled and written-off loans are added, according to them. BANKING HAMSTRUNG IN MASS UPRISING Student-led nationwide movement in July and the anti-government campaign in August largely disrupted the banking services. To quell the movement, the Awami League-led government suspended internet facilities nationwide for almost a week. These internet outages crippled digital banking, internet banking and remittance earnings. After the fall of the Awami League government in early August, there were also cash withdrawal restrictions throughout the month. Besides, most of the automated teller machines (ATMs) were closed for a prolonged period due to security concerns. BANKING SECTOR UNDER THE INTERIM GOVT After the formation of the interim government, Ahsan H Mansur, a reputed economist, became the governor of the Bangladesh Bank by replacing Abdur Rouf Talukder. After assuming office, new governor Mansur restructured the boards of eleven banks, six of which were dominated by the controversial S Alam Group. The banking regulator also formed three taskforces on non-performing loan management, strengthening project and legal frameworks to continue and accelerate reforms. Meanwhile, the interim government appointed a pool of experts to prepare a report on the state of the economy. The expert team submitted their white paper on the economic state of Bangladesh to the chief adviser in December, which dedicated a chapter, titled "Deep into a Black Hole," elaborating on banking irregularities. The BB initiated forensic audits in crisis-hit banks, efforts to bring back laundered money and strengthening the capacity of the central bank with the help of the World Bank and IMF. Besides, a government taskforce was formed to investigate money laundering and other misdeeds allegedly carried out by 10 major business groups in the country: S Alam Group, Beximco Group, Summit Group, Bashundhara Group, Gemcon Group, Orion Group, Nabil Group, Nassa Group, Sikder Group and Aramit Group. While these reform measures marked a critical point to restore public confidence and strengthen regulatory oversight, the road to recovery remains long and uncertain. In October, a video on social media showed the manager of Social Islami Bank's Agargaon branch breaking down in tears after enduring harsh verbal abuse from frustrated customers seeking to withdraw cash. It didn't take long to go viral. The severe cash crunch at Social Islami Bank was far from an isolated incident. Throughout October and November, protests erupted inside the branches of several banks, with angry clients blocking branch managers to recover their money. The social media footage itself was a testament to the fragile state of the banking sector — a system teetering under the weight of corruption, mismanagement and a crisis of confidence. At the heart of the turmoil were several Shariah-based banks heavily controlled by S Alam Group, a controversial business conglomerate whose governance failures and financial irregularities cast a shadow over the entire sector. For years, the true state of Bangladesh's banking system remained obscured by political interference and flawed policies during Sheikh Hasina's 15-year rule. After her fall in early August, the extent of the dysfunction became painfully clear. In 2024, the banking sector faced a perfect storm of challenges: liquidity shortages in Shariah-based lenders, foreign exchange instability, soaring inflation, ill-conceived mergers and a seismic increase in non-performing loans. As part of its $4.7 billion loan programme for Bangladesh, the International Monetary Fund (IMF) made financial sector reforms a key condition. While the previous government had resisted the demands for reform, the interim administration that came after Hasina's exit moved swiftly to address systemic irregularities and implement a broad reform agenda. Towards the end of the year, a slew of steps had been taken, though the path to stability remained fraught with difficulty. A GLOOMY START The year began under a cloud of economic uncertainty. Inflation surged to 11.66 percent in July -- the highest in 13 years. The price pressure has been hovering above the 9 percent mark since March 2023. Despite the government and the central bank's efforts, including multiple policy rate hikes, inflationary pressures showed little sign of easing. To make things worse, the foreign exchange market faced unrelenting volatility for months. Over two years, the country's dollar stocks had halved and local currency Taka had depreciated by about 28 percent. These burdens further strained the banking sector, specially for Shariah-based lenders already wrestling with governance failures and liquidity shortfalls. BB's LIQUIDITY SUPPORT ALL THROUGH 2024 To protect the banking sector from a collapse, the Bangladesh Bank (BB) injected fresh funds into struggling banks throughout the year. The lack of securities tied to these liquidity supports fueled inflation and drew criticism for making things difficult in the long run. Critics argued that such measures merely postponed the reckoning, without addressing the structural flaws undermining the sector. At the end of 2023, the central bank provided Tk 22,000 crore in emergency funds to seven beleaguered banks, including five Islamic ones, to dress up their balance sheets before the year closed. Then, in January, the banking regulator provided Tk 12,000 crore to six banks against the special purpose treasury bond issued by the government to settle outstanding payments for fertiliser and power. Economists came down heavily on these fund injections, arguing that those fueled inflation by "printing money". Under the interim government, the central bank also extended Tk 22,500 crore as liquidity support to six crisis-hit banks in November. FAULTY MERGER MOVE As per the instruction of the previous government, Abdur Rouf Talukder, former governor of the central bank, took an initiative to merge five weak banks with sound ones. The move prompted massive instability in the banking sector as depositors of the weak banks rushed to withdraw cash. The decision to merge the weak and problematic Padma Bank with the EXIM Bank in March was the first merger initiative. Later, names of a few more banks came to light for merger, which eventually caused the lenders to face a liquidity crisis due to massive deposit withdrawals. However, after the political changeover, the merger decision was cancelled. THE RETURN OF MARKET-BASED INTERESTS In May this year, the BB was forced to reintroduce market-based interest rates after shelving it for four years. The reintroduction was to meet the conditions of the IMF. The central bank, in line with the government instruction in 2020, introduced a single-digit lending rate which allowed banks to charge a maximum 9 percent interest rate on lending. Economists criticised the single-digit lending rate policy as it created an opportunity for bad borrowers to take funds at a cheap rate and launder it abroad. The single-digit lending rate also contributed to high inflation. In July 2023, the central bank withdrew the 9 percent lending rate cap and introduced the Six-Months Moving Average Rate of Treasury bills (SMART) formula for setting the interest rate. In May this year, the banking regulator scrapped the SMART formula to let the market decide interest rates on commercial lending. At the same time, the BB introduced a crawling peg exchange rate system for buying and selling foreign currencies and allowed banks to buy and sell US dollars at around Tk 117. BAD LOANS REACHED RECORD HIGH At the end of September this year, non-performing loans (NPLs) in the banking sector reached Tk 2,84,977 crore. The figure included a massive Tk 73,586 crore defaulted in just three months. Between July and September, bad debts soared by 34.8 percent, according to the BB. Industry insiders said that the actual scenario of the sector came to light less than two months after the fall of Sheikh Hasina on August 5. The actual bad loans will likely cross Tk 5,00,000 crore when rescheduled and written-off loans are added, according to them. BANKING HAMSTRUNG IN MASS UPRISING Student-led nationwide movement in July and the anti-government campaign in August largely disrupted the banking services. To quell the movement, the Awami League-led government suspended internet facilities nationwide for almost a week. These internet outages crippled digital banking, internet banking and remittance earnings. After the fall of the Awami League government in early August, there were also cash withdrawal restrictions throughout the month. Besides, most of the automated teller machines (ATMs) were closed for a prolonged period due to security concerns. BANKING SECTOR UNDER THE INTERIM GOVT After the formation of the interim government, Ahsan H Mansur, a reputed economist, became the governor of the Bangladesh Bank by replacing Abdur Rouf Talukder. After assuming office, new governor Mansur restructured the boards of eleven banks, six of which were dominated by the controversial S Alam Group. The banking regulator also formed three taskforces on non-performing loan management, strengthening project and legal frameworks to continue and accelerate reforms. Meanwhile, the interim government appointed a pool of experts to prepare a report on the state of the economy. The expert team submitted their white paper on the economic state of Bangladesh to the chief adviser in December, which dedicated a chapter, titled "Deep into a Black Hole," elaborating on banking irregularities. The BB initiated forensic audits in crisis-hit banks, efforts to bring back laundered money and strengthening the capacity of the central bank with the help of the World Bank and IMF. Besides, a government taskforce was formed to investigate money laundering and other misdeeds allegedly carried out by 10 major business groups in the country: S Alam Group, Beximco Group, Summit Group, Bashundhara Group, Gemcon Group, Orion Group, Nabil Group, Nassa Group, Sikder Group and Aramit Group. While these reform measures marked a critical point to restore public confidence and strengthen regulatory oversight, the road to recovery remains long and uncertain.Group of Seven allies are set to step up pressure on China while offering Kyiv “unwavering commitment” amid accusations that Beijing has increased support for Russia in its war against Ukraine. The G-7 foreign ministers, who are meeting in Italy on Monday and Tuesday, are expected to vow “appropriate measures consistent with our legal systems, against actors in China and in other third countries” who are supporting Russia’s “war machine” in Ukraine, according to an early draft of the communique seen by Bloomberg. Ukraine’s allies are seeking to crack down on countries aiding Moscow’s war effort, particularly before Donald Trump takes office in January. During his campaign, Trump expressed deep skepticism about U.S. support for Ukraine and has said he can end the war quickly. The language on China, if adopted, would represent an escalation compared with the previous foreign ministerial meeting in April, when the club of nations called on China to “ensure” that it stops its support for Russia with dual-use weapons. North Atlantic Treaty Organization allies in July called China a “decisive enabler” of Russia’s war against Ukraine. The G-7 allies are also expected to “continue to apply significant pressure on Russian revenues from energy, metals and other commodities through the effective implementation of existing measures and further actions against the ‘shadow fleet’.” The new measures would seek to curb the use of a covert fleet of tankers Russia has assembled to get around a price cap and restrictions that target Russia’s ability to get its oil to market. Communiques are often changed before the final version is published and tweaks could still be made to the wording. The European Union’s foreign affairs ministers discussed the issue last week and German Foreign Minister Annalena Baerbock warned that China’s assistance for Russia “will and must have consequences.” The latest conversations on China’s role come after Bloomberg reported in July that Chinese and Russian companies are developing an attack drone similar to an Iranian model deployed in Ukraine. This raised fears that Beijing may be edging closer to providing the sort of lethal aid that western officials have warned against. The U.S. approved the use of long-range weapons against Russia, while Moscow launched a “new” kind of ballistic missile at Ukraine last week. Another section of the draft condemns North Korea’s deployment of its soldiers in Ukraine and calls for de-escalation in the Middle East. The use of North Korean soldiers “marks a dangerous expansion of the conflict,” according to the draft, which also raises concerns about the transfer of nuclear technology to North Korea. While the U.S. has approved the use of long-range weapons against Russia, diplomats with knowledge of the negotiations said there was likely not going to be any such consensus in the final communique as some nations, for example Italy, do not support this stance and have repeatedly said the weapons they provide should only be used defensively.

BETHESDA, Md. , Dec. 11, 2024 /PRNewswire/ -- AGNC Investment Corp. (Nasdaq: AGNC ) announced today that its Board of Directors has declared a cash dividend of $0.12 per share of common stock for December 2024 . The dividend is payable on January 10, 2025 to common stockholders of record as of December 31, 2024 . For further information or questions, please contact Investor Relations at (301) 968-9300 or [email protected] . ABOUT AGNC INVESTMENT CORP. Founded in 2008, AGNC Investment Corp. (Nasdaq: AGNC ) is a leading investor in Agency residential mortgage-backed securities (Agency MBS), which benefit from a guarantee against credit losses by Fannie Mae, Freddie Mac, or Ginnie Mae . We invest on a leveraged basis, financing our Agency MBS assets primarily through repurchase agreements, and utilize dynamic risk management strategies intended to protect the value of our portfolio from interest rate and other market risks. AGNC has a track record of providing favorable long-term returns for our stockholders through substantial monthly dividend income, with over $13 billion of common stock dividends paid since inception. Our business is a significant source of private capital for the U.S. residential housing market, and our team has extensive experience managing mortgage assets across market cycles. To learn more about The Premier Agency Residential Mortgage REIT , please visit www.AGNC.com , follow us on LinkedIn and X , and sign up for Investor Alerts . CONTACT: Investor Relations - (301) 968-9300 SOURCE AGNC Investment Corp.Victor Wembanyama went to a park in New York City and played 1-on-1 with fans on Saturday. He even lost a couple of games. Not in basketball, though. Wemby was playing chess. And this wasn't on a whim: He knows how to play and even brought his own chess set. Before the San Antonio Spurs left New York for a flight to Minnesota, Wembanyama put out the call on social media: “Who wants to meet me at the SW corner of Washington Square park to play chess? Im there,” Wembanyama wrote. It was 9:36 a.m. People began showing up almost immediately. Washington Square Park is a known spot for chess in New York — Bobby Fischer among others have famously played there, and it's been used for multiple movie scenes featuring the game. Wembanyama was there for an hour in the rain, from about 10-11 a.m. He played four games, winning two and losing two — he told Bleacher Report afterward that both of the losses were to professional chess players — before departing to catch the Spurs' flight. Wembanyama had been trying to get somewhere to play chess for the bulk of the team's time in New York — the Spurs played the Knicks on Christmas and won at Brooklyn on Friday night. The schedule never aligned, until Saturday morning. And even with bad weather, he bundled up to make it happen. He posed for photos with a couple of dozen people who showed up, braving a morning of cold rain to play chess with one of the NBA's biggest stars. “We need an NBA players only Chess tournament, proceeds go to the charity of choice of the winner,” he wrote on social media after his chess trip was over. Wembanyama is averaging 25.2 points and 10.1 rebounds this season, his second in the NBA after winning rookie of the year last season. The Spurs play at Minnesota on Sunday.Lori Borgman | The little house that sat empty and alone

Startup with a Lincoln connection is automating cattle feedingNone

- Previous: bmy88 app download apk

- Next: wie starb sisi